ANNOUNCEMENTS

By Ranjana Ray Chaudhuri, Associate Professor and Head of the Departments of Natural and Applied Sciences and Regional Water Studies, TERI School of Advanced Studies

Air pollution is one of India’s deadliest health threats, causing 1.5 million deaths in a decade. A coordinated, science-led strategy is now reversing the trend, with strict regulations, biomass use, and cleaner fuels improving air quality—though much work remains.

In India, air has become a public health disaster, challenging both governance and public resolve. A slow, unseen threat that deprives people of years before their time, air pollution caused 1.5 million deaths in India between 2009 and 2019, as per the Lancet Planetary Health study. This accounts for nearly one in every six deaths nationwide. It is one of the country’s deadliest health threats, claiming more years of life lost than even cardiovascular or infectious diseases. Particulate pollution alone shortens the average Indian’s life by 5.3 years. In the Northern Plains, the worst-hit region, the number increases to about 8 years of life lost for nearly 521 million residents.

In 2019, the economic costs from premature deaths and illnesses linked to air pollution reached $36.8 billion, or 1.36% of India’s GDP 4 . This is a multi-faceted attack on health, society, and the economy, in the guise of an environmental issue. The problem looms over India like Damocles’ sword—a scepter that haunts our national productivity, stunts children’s growth, hampers adolescents’ lung and cognitive development and burdens hospitals.

CAQM as a Panacea

Faced with such a crisis, piecemeal interventions are no longer enough. India needs a science-backed authority with the mandate to cut across state lines and enforce tough decisions. The Commission for Air Quality Management (CAQM), set up in 2020 and given statutory powers under the CAQM Act, 2021, has emerged as that very institution. Its jurisdiction spans Delhi-NCR and neighbouring states, Punjab, Haryana, Uttar Pradesh, and Rajasthan, where it can issue binding directions to state agencies, impose environmental compensation, and prosecute non-compliance.

CAQM’s strategy has zeroed in on two critical fronts in the fight against air pollution: managing agricultural residue to curb stubble burning and driving industrial decarbonisation to cut emissions at the source.

In agriculture, CAQM has created Parali Protection Forces for district-level oversight, satellite-based burnt area tracking with ISRO, and the legal empowerment of District Magistrates to prosecute violations. Together, these measures have driven a dramatic decline in crop residue fires. Punjab saw incidents fall from 71,304 in 2021 to 10,909 in 2024, while Haryana dropped from 6,829 to 1,315 . To create a sustainable outlet for farm waste, the Commission has also advanced biomass co-firing in coal-based power plants, blending paddy straw with coal to reduce coal consumption and avoid open burning. This began in 2021, when 11 thermal plants within 300 km of Delhi were directed to co-fire 5–10% biomass.

In June 2025, the mandate expanded to brick kilns in non-NCR districts of Punjab and Haryana, with a phased plan to achieve 50% paddy straw-based biomass use by November 2028.

In 2023, CAQM strengthened industrial decarbonisation by mandating strict and immediate compliance with emission limits for particulate matter, sulphur dioxide, nitrogen oxides, mercury, and water use in coal- and lignite-based thermal power plants, in line with standards set and periodically updated by the Ministry of Environment, Forest and Climate Change. This regulatory push has strengthened compliance across the industrial and power sectors. CAQM has also boosted biomass pellet production, including the once-scarce torrefied type, through access to technology, training, and subsidies provided by the Central Pollution Control Board and state governments.

More read:-

https://fehealthcare.financialexpress.com/blogs/caqms-blueprint-for-breathing-easier-in-indias-most-polluted-regions

Read More

Across seven multi-season surveys, Wildlife Institute of India researchers searched for bird carcasses within a 150-m radius of 90 randomly selected wind turbines and found 124.

In the first half of 2025, India added around 3.5 GW to the wind sector – an 82% year-on-year growth – taking the total installed capacity to 51.3 GW. Even so, India’s wind power remains largely untapped. According to the National Institute of Wind Energy, India’s gross wind power potential is 1163.9 GW at 150 m above ground level.

At the Global Wind Day Conference in June, Union Minister of New and Renewable Energy Pralhad Joshi urged States to address land availability and transmission delays post-haste.

India’s ambitious climate goals and surging energy demands mean renewable energy development will continue to accelerate. Experts are concerned, however, that the addition of wind power capacity has been coming at the expense of avian welfare.

Bird mortality at wind farms

For years, researchers have raised concerns about the impact of wind turbines on fauna, particularly birds. A study by the Wildlife Institute of India (WII), published recently in Nature Scientific Reports, has estimated globally high bird mortality rates at wind farms in the Thar Desert.

The study was conducted in a 3,000 sq. km desert landscape in Jaisalmer, Rajasthan, home to around 900 wind turbines and 272 bird species, including the critically endangered great Indian bustard. Across seven multi-season surveys, WII researchers searched for bird carcasses within a 150-m radius of 90 randomly selected wind turbines and found 124.

The estimated annual bird mortality per 1,000 sq. km came up to 4,464 birds after correcting for non-detection due to vegetation cover or carcass degradation during the survey and due to carcass scavenging before the survey.

The researchers conducted similar surveys at 28 randomly selected control sites (between 500 and 2,000 m of any turbine) to account for the natural mortality of birds and found no carcasses.

“Very few studies have robust data to have accurate assessments that correct for detection issues and have controls for comparison,” Yadvendradev Jhala, one of the authors of the study, said.

The WII study isn’t the first to examine bird mortality in wind farms in India. A 2019 study documented bird deaths at wind farms in Kutch and Davangere. However, the estimate of 0.47 bird deaths per turbine per year at both sites now pale in comparison to the 1.24 bird deaths per turbine per month in the Thar Desert.

“It’s quite a high estimate, but that’s quite possible,” Ramesh Kumar Selvaraj, an independent consultant and author of the 2019 paper, said. “[Mortality rate] will vary depending on geography, season, and other factors.”

Bird density, infrastructure density, and configuration are crucial factors, according to Jhala. The Thar Desert is part of the Central Asian Flyway — a major migration route for birds across Eurasia — and a prominent wintering destination.

The desert mortality estimates also included bird collisions with power lines linked to the wind turbines. The Gujarat and Karnataka study didn’t include this cause.

Per both studies, raptors were the most affected group of birds, echoing findings worldwide. “Raptors are long-lived species that lay fewer eggs, and any additional mortality can lead to population-level impacts,” Selvaraj said. “Their flight altitude and soaring flight behaviour means they are more vulnerable while manoeuvring rotating wind turbines.”

Organisations like Birdlife International have proposed several mitigation measures to reduce bird collisions with wind turbines, including painting one of the turbine blades to increase visibility and shutting turbines down at a certain time of day or season. However, Selvaraj said he believes the most crucial step in mitigation is to carefully select the site of a wind farm.

Avian Sensitivity Tool for Energy Planning (AVISTEP) is an open-source platform developed by Birdlife International that helps developers identify and avoid sites where renewable energy could affect birds. Selvaraj, previously with the Bombay Natural History Society, coordinated India’s map for AVISTEP.

“The whole of India, including offshore areas, have been divided into different categories of avian sensitivity such as ‘low’, ‘moderate’, ‘high’, and ‘very high’,” Selvaraj said. “While AVISTEP can serve as a guide, ground-level studies are crucial before installing wind farms,” he added.

However, onshore wind energy projects in India aren’t mandated to conduct an environmental impact assessment (EIA) before installation.

From land to ocean

Offshore wind farms are emerging as a valuable renewable energy resource worldwide. According to the Global Wind Energy Council, operational offshore wind capacity worldwide is currently around 83 GW.

India has also turned its attention offshore and aims to install 30 GW of offshore wind capacity by 2030. In June, the Ministry of New and Renewable Energy launched offshore wind energy bids totalling 4 GW in Gujarat and Tamil Nadu.

The primary motivation is to look beyond land-based resources, which are becoming increasingly “complex” and “time-consuming” to procure for renewable project development, Disha Agarwal, senior programme lead, Council on Energy, Environment and Water (CEEW), New Delhi, said.

With a coastline stretching across 7,600 km and exclusive economic zones covering 2.3 million sq. km, India has considerable offshore wind energy potential.

According to CEEW research, the addition of offshore wind to the renewable energy pool in Gujarat will benefit power system operations in the State. “We saw that offshore wind will aid in system adequacy and help meet reliability requirements during peak load hours,” Agarwal said

However, despite the growing interest, there has been limited research on the environmental consequences of offshore wind farms.

Offshore wind energy is a complex infrastructure asset that requires detailed marine spatial planning exercises to assess environmental and social impacts, according to Gopal K. Sarangi, head of the Department of Policy and Management Studies at the TERI School of Advanced Studies, New Delhi.

“As observed in other countries, there are numerous environmental risks for offshore wind farms,” Sarangi said. “They could disturb marine biodiversity, create noise pollution for marine habitats, and pollute the ocean water at various stages of project development.”

According to the National Offshore Wind Energy Policy, unlike other renewable energy developments in the country, EIAs are essential for offshore wind energy.

The rapid EIA report of the proposed offshore wind farm in the Gulf of Khambhat in Gujarat documented five marine mammals, including dolphins and sharks, and a reptile within the study area. While the report recognised that increased turbidity and noise levels during the construction phase of the wind farm may drive away highly sensitive species, it deemed the noise and vibrations during the operation phase to be “limited”.

Selvaraj said he doesn’t agree with the report’s inference that there are very few bird species passing through the study region. “Gujarat and its coasts are a key area within the Central Asian Flyway and the African-Eurasian Flyway,” according to him.

Per AVISTEP as well, the proposed location has a high avian sensitivity score. Thus, Selvaraj urged a longer, more thorough study to understand how migratory bird species use the area and the possible effects of wind farms on these birds.

Nikhil Sreekandan is an independent journalist.

Read More| Date | News Title | Source |

| 14-August-2025 | CAQM Blueprint for Breathing E... | Financial Express (HealthCare Online) |

| 03-August-2025 | Bird deaths raise red flags as... | The Hindu (Online) |

| 18-July-2025 | 1 in 4 Indian married couples ... | The Indian Express |

| 23-June-2025 | Blended Learning: Driving educ... | The Pioneer |

| 22-June-2025 | All adults overweight in every... | |

| 21-June-2025 | TERI SAS Nurturing Global Sust... | The Interview World (Online) |

| 27-May-2025 | Eco-education trend grows: Sus... | India Today (Online- Education Desk) |

| 25-March-2025 | How water green credits can fu... | Hindustan Times (Opinion) |

| 23-February-2025 | Sustainable biz practices disc... | The Times of India (Online) |

| 21-February-2025 | Sangam fit for bath’, Enviro... | News9 (Online) |

Mini

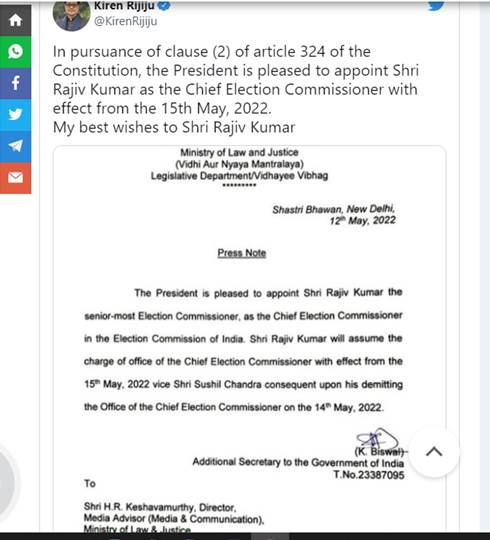

While in office, the 1960-born Kumar will oversee the 2024 Lok Sabha elections and several Assembly polls along with the elections of the president and vice-president of India.

The Ministry of Law has appointed former finance secretary and current Election Commissioner Rajiv Kumar as the next chief election commissioner (CEC). He will assume charge from May 15 after incumbent CEC Sushil Chandra retires on May 14.

After the announcement, Law Minister Kiren Rijiju tweeted, “My best wishes to Shri Rajiv Kumar.”

Kumar was appointed as the election commissioner on September 1, 2020. He is likely to demit office in February 2025. While in office, Kumar will oversee the 2024 Lok Sabha election and several Assembly polls along with the elections of the president and vice-president of India.

More about Rajiv Kumar

Born on February 19, 1960, Kumar holds degrees in BSc, LLB, PGDM, and a Master’s degree in public policy. According to his LinkedIn profile, Kumar completed his LLB from Delhi University between 1979 and 1982. He is also an alumnus of the TERI School of Advanced Studies.

He is an Indian Administrative Service officer of the 1984-batch, who superannuated from service in February 2020.

The 62-year-old officer has extensive experience in working “across the social sector, environment and forests, human resources, finance and banking sector,” a government statement had said earlier.

Kumar’s contribution as an officer

Kumar held the post of finance secretary between September 2017 and February 2020. During his tenure, he undertook several banking, insurance and pension reforms. To curb circulation of black money, the officer froze bank accounts of 3.38 lakh shell companies, which were used for creating fictitious equity.

For public sector banks, Kumar implemented a recapitalisation programme of Rs 2.11 lakh crore to support capital adequacy of these institutions and prevent default. He is credited with implementing prudential norms of lending for bankers and borrowers.

Kumar has been instrumental in streamlining the National Pension System (NPS) which extends its benefits to about 18 lakh central government employees.

Kumar has also held other positions such as director for the Central Board of Reserve Bank of India (RBI), SBI and NABARD. He has also been member of the Economic Intelligence Council (EIC), Financial Stability and Development Council (FSDC), Bank Board Bureau (BBB) and Financial Sector Regulatory Appointments Search Committee (FSRASC).

As the director and joint secretary in the Tribal Affairs Ministry between 2001 and 2007, Kumar drafted the Scheduled Tribes (Reorganisation of Forests Rights) Bill, 2005. It was under his supervision that the Special Central Assistance to States and Grants under Art. 275(1) of the Constitution was granted for the development of scheduled and tribal areas.

Prior to being appointed as the election commissioner, Kumar had held the post of chairman of the Public Enterprises Selection Board since April 2020.

Trekking in Himalayas

According to the ECI portal, Kumar is a keen trekker and has crossed several passes in the Himalayan Mountain range in Ladakh, Uttarakhand, Himachal Pradesh, Tibet and Sikkim. He has also trekked in Sahyadri mountain ranges or the Western Ghats. Apart from trekking, Kumar enjoys listening to Indian vocal classical and devotional music, and practises meditation.

Plot No. 10, Institutional Area, Vasant Kunj, New Delhi - 110 070, India.

Tel. +91 11 71800222 (25 lines).

Website : www.terisas.ac.in

Email id : registrar@terisas.ac.in

© Copyright © 2025, TERI SAS, All rights reserved.

Visitors No.: 47116599 Since 2023